In This Article:

-

Why Canadian Real Estate Continues to Attract Smart Money

Why Canadian Real Estate Continues to Attract Smart Money

-

Condominiums: Your Gateway to Urban Investment

Condominiums: Your Gateway to Urban Investment

-

Single-Family Homes: The Classic Wealth Builder

Single-Family Homes: The Classic Wealth Builder

-

Multi-Family Properties: Cash Flow Champions

Multi-Family Properties: Cash Flow Champions

-

Commercial Real Estate: Where the Big Returns Live

Commercial Real Estate: Where the Big Returns Live

-

Emerging Investment Opportunities

Emerging Investment Opportunities

-

How to Choose Your Perfect Investment Property Type

How to Choose Your Perfect Investment Property Type

-

Why Professional Management Makes the Difference

Why Professional Management Makes the Difference

-

Your Next Steps to Investment Success

Your Next Steps to Investment Success

Why Canadian Real Estate Continues to Attract Smart Money

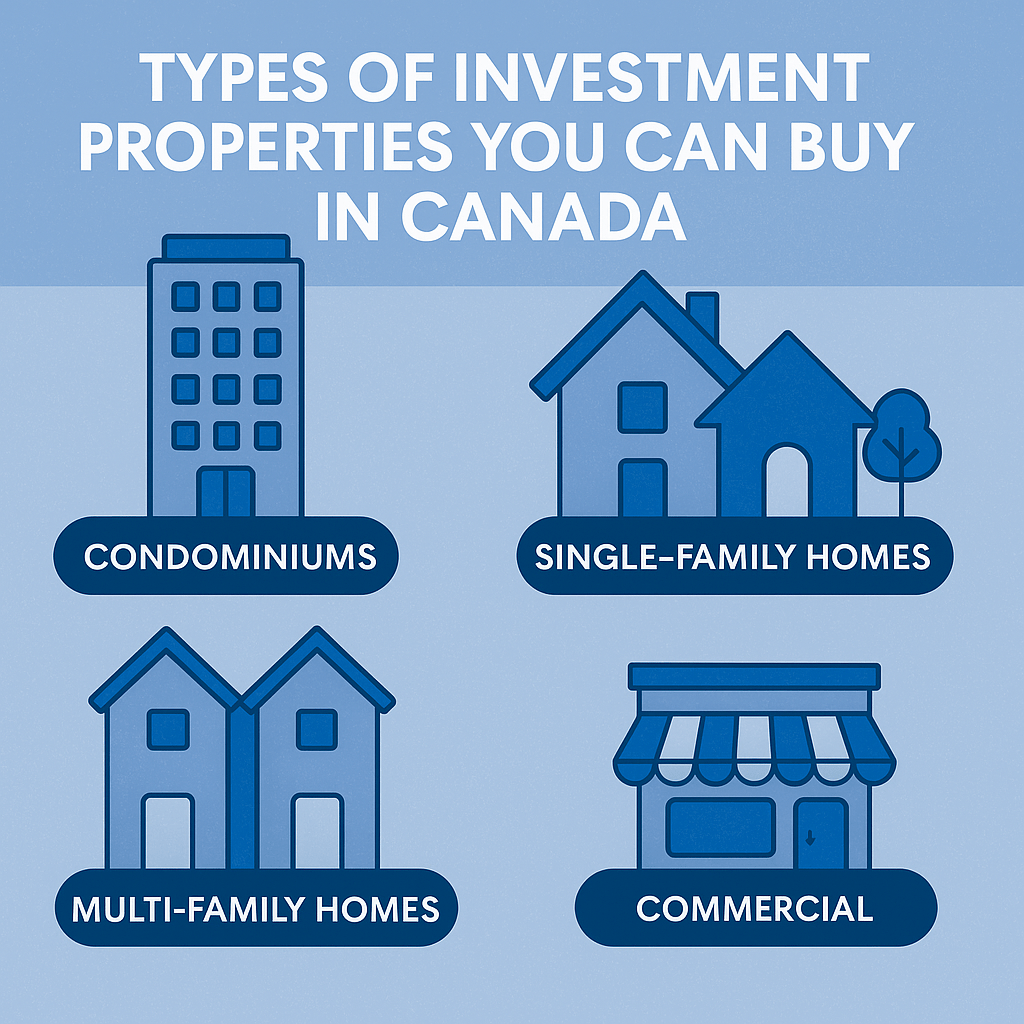

Canadian real estate continues to shine in 2025 thanks to stability, legal transparency, and strong rental demand. Ontario regions like Belleville and Quinte West offer affordable opportunities and promising growth.

Condominiums: Your Gateway to Urban Investment

Condos offer low-maintenance entry into real estate, especially in urban centers. They’re perfect for investors seeking hands-off operations, access to downtown markets, and built-in amenities.

- ✅ Lower entry cost

- ✅ Prime locations

- ✅ Shared maintenance

- ⚠️ Monthly condo fees

- ⚠️ Limited control via condo boards

Single-Family Homes: The Classic Wealth Builder

Owning the land and the home offers more control and often greater appreciation over time. They attract long-term tenants, especially families.

- ✅ Complete control and flexibility

- ✅ Potential for secondary units

- ⚠️ Maintenance responsibilities

- ⚠️ Higher upfront costs

Multi-Family Properties: Cash Flow Champions

Duplexes and triplexes diversify income and reduce vacancy risk. Many full-time investors build wealth with small apartment buildings.

- ✅ Diversified income

- ✅ Better cash flow

- ⚠️ Complex management

- ⚠️ Higher price points

Commercial Real Estate: Where the Big Returns Live

Commercial investments like office or retail buildings offer strong returns but require capital and expertise.

- ✅ Long leases and triple net benefits

- ✅ Higher yields (6-12%)

- ⚠️ Requires experience

- ⚠️ Longer vacancy periods

Emerging Investment Opportunities

- Student housing: Growing demand from international students

- Build-to-rent: Purpose-built rental communities

- Mixed-use developments: Combine residential, retail, and commercial

How to Choose Your Perfect Investment Property Type

Match your investment style to property type:

- 🎯 Do you prefer cash flow or appreciation?

- 📆 Long-term or short-term hold?

- 🏢 Passive or active management?

- 💰 How much capital are you starting with?

Why Professional Management Makes the Difference

Partnering with an experienced team like Blue Anchor Property Management helps protect your investment and ensure compliance with Ontario’s regulations.

- 📊 Rent optimization and financial tracking

- 🔍 Tenant screening

- 🛠️ 24/7 maintenance coordination

- ⚖️ Legal compliance and updates

Your Next Steps to Investment Success

Ready to take the leap? Here’s your action plan:

- Define your investment goals

- Choose your preferred property type

- Research Ontario markets

- Build your team (agent, lawyer, property manager)

- Visit Blue Anchor’s blog for ongoing guidance

Real estate in Canada is full of opportunity—let’s make it work for you.