Ontario Cap Rate Calculator Comparison: Belleville vs Toronto vs Ottawa

In This Article:

What Is a Cap Rate (and Why Does It Matter)?

A cap rate (short for capitalization rate) tells you how much income a property generates relative to its value. It’s calculated as:

Cap Rate = Net Operating Income ÷ Property Value

Cap rate helps investors:

- Compare different properties across cities

- Evaluate risk vs reward

- Decide whether a property is underperforming

- Benchmark investments based on current markets

If you’re not already using this metric, now is the time to start.

👉 Want a quick way to calculate your own cap rate?

Use our Ontario Cap Rate Calculator — it’s free, simple, and investor-friendly.

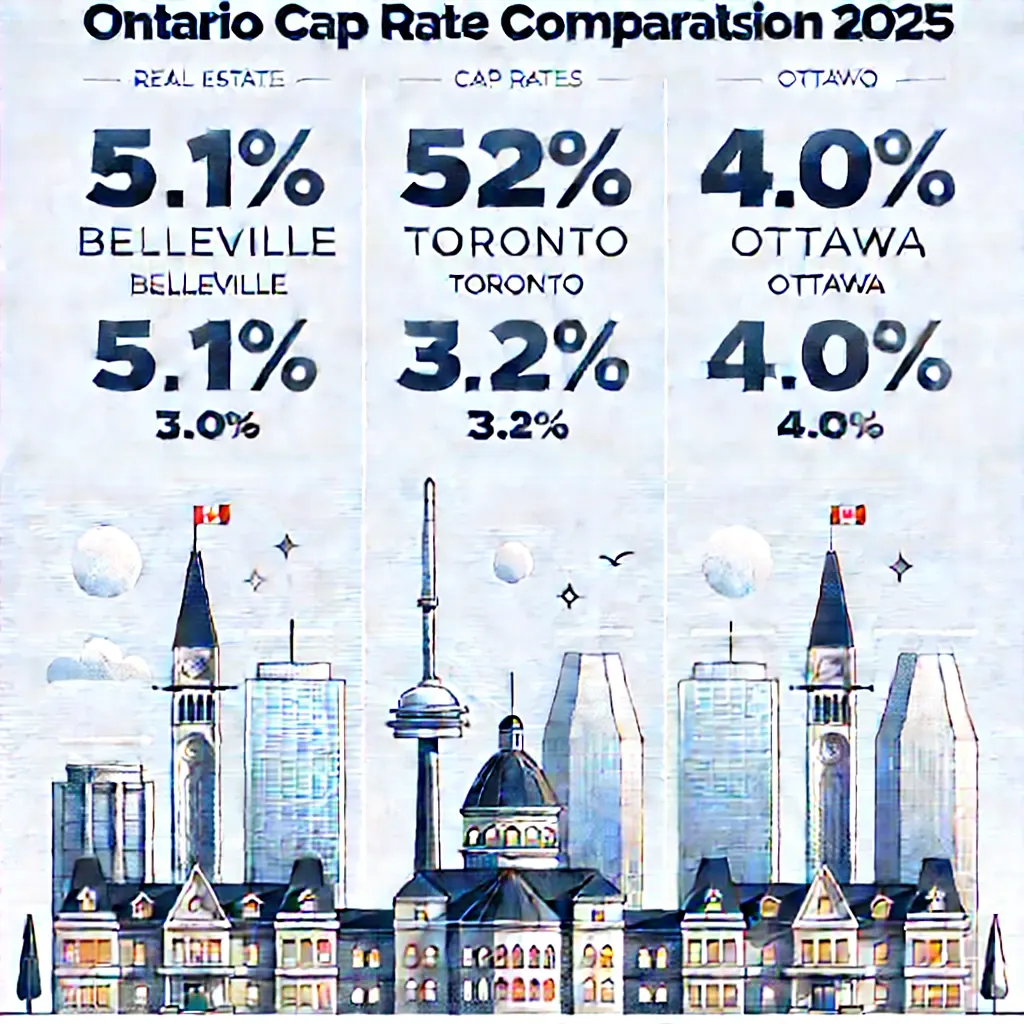

2025 Cap Rate Comparison: Belleville vs Toronto vs Ottawa

We crunched the numbers using average rents, property values, and local expense estimates. Here’s how the three cities compare in 2025:

| City | Avg Monthly Rent | Avg Property Price | Cap Rate |

|---|---|---|---|

| Belleville | $1,800 | $420,000 | 5.1% |

| Toronto | $2,300 | $750,000 | 3.2% |

| Ottawa | $2,100 | $600,000 | 4.0% |

How to Use This Comparison in Real Life

If you’re analyzing your next investment, a cap rate comparison like this helps you ask:

- Am I overpaying for returns?

- Could I get a better ROI in a secondary market?

- Is my current property keeping up with local benchmarks?

You don’t need to guess. Use a tool like the Blue Anchor Cap Rate Calculator to plug in your own numbers and compare your property to these city averages.

What Affects Cap Rate Differences Between Cities?

Cap rates reflect more than just rent — they also consider:

- Property taxes

- Vacancy rates

- Demand and competition

- Maintenance and utility costs

- Average tenant stability

For example, Toronto has high appreciation potential but lower cap rates due to property costs. Belleville has lower overhead and strong demand from renters, resulting in a better cash return on investment — especially in multifamily units.

Should You Chase the Highest Cap Rate?

Not always. A higher cap rate might also mean:

- Higher turnover

- More maintenance headaches

- Location-based risk (economic shifts, student population, etc.)

The best strategy? Balance cap rate with your comfort level, risk tolerance, and long-term goals.

Want more tips on how to evaluate ROI across regions?

👉 Read our guide to real estate deal analysis

Final Thoughts: Where Should You Invest in 2025?

There’s no single “best” Ontario market — but cap rate data helps you make informed, confident decisions.

- Want maximum monthly income? Belleville is worth a look.

- Want long-term value growth with stability? Consider Ottawa.

- Want to be in the country’s most dynamic market? Toronto still leads — but with slimmer margins.

🧮 Try our Ontario Cap Rate Calculator to explore your own numbers today.

Compare smarter. Invest better. Stay ahead — with Blue Anchor.